-

Address Delaware , USA

-

Email info@upcoretech.com

-

Phone +1 (302) 319-2026

When a top Asian bank found its mobile banking app plagued with poor ratings, crashes, and limited capabilities, it turned to Upcore Technologies. Over a 4-month engagement, Upcore conducted an audit, rebuilt functionality using agile sprints, and integrated innovations like AI. The transformed app delivered a cutting-edge experience that boosted the app store rating to 4 stars, skyrocketed customer satisfaction through reduced defects, and increased engagement, adoption and ultimately revenues. By partnering with Upcore, the bank successfully executed a digital transformation initiative to reinvigorate its mobile customer experience.

The client is a prominent bank based in Asia with over 20 years of successful operation and a leading position in its domestic market. The bank serves millions of retail and business customers across the region.

The client's existing Android mobile banking application was poorly rated on the Google Play store, plagued by 1-star reviews citing frequent crashes, functionality bugs, and performance issues. Customers were frustrated with the app's instability and limited capabilities compared to competitors. The client's in-house technology team lacked the expertise to fully diagnose the root causes and execute impactful upgrades. The dated application was hurting customer satisfaction, adoption and retention.

As part of a digital transformation initiative, the bank sought a solution to thoroughly revamp its mobile app and deliver a modernized experience on par with banking leaders. The goals included boosting the app rating, reducing defects and performance problems, and rolling out new capabilities to drive customer engagement.

The client selected Upcore Technologies as the strategic partner to overhaul the mobile application based on their technical expertise and proven methodology. The 4-month engagement commenced with a comprehensive audit of the existing mobile app codebase, architecture, infrastructure, and technologies.

Upcore outlined the critical performance issues and glitches causing app crashes. The assessment also highlighted gaps in capabilities compared to high-performing competitors. Armed with these insights, Upcore formulated a transformation roadmap focused on rebuilding functionality, eliminating defects, and integrating innovations like AI.

Upcore's team of 2 Android developers and a project manager followed an agile approach to iteratively enhance the application over multiple 2-week sprints. Rather than redesigning the UI, they focused on under-the-hood improvements for a streamlined customer upgrade path. Upcore integrated cutting-edge technologies to introduce new differentiating capabilities.

- Intuitive dashboards for accounts, deposits, loans, and cards

- Real-time exchange rates and currency conversions

- Streamlined transfers, payments, and card controls

- Digital card issuance and management

- Location finder for nearby ATMs and branches

- Forex and equity trading capabilities

- AI-powered virtual assistant for self-service

- Travel insurance purchases through travel agent integration

The application stability saw considerable improvements by resolving memory leaks, optimizing data calls, implementing better exception handling, and adding monitoring. Rigorous testing ensured all flows worked seamlessly.

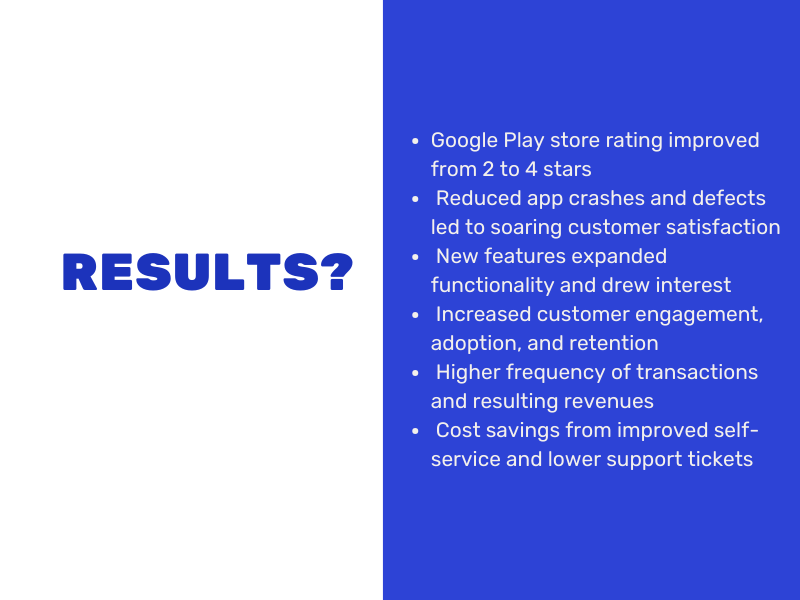

- Google Play store rating improved from 2 to 4 stars

- Reduced app crashes and defects led to soaring customer satisfaction

- New features expanded functionality and drew interest

- Increased customer engagement, adoption, and retention

- Higher frequency of transactions and resulting revenues

- Cost savings from improved self-service and lower support tickets

By partnering with Upcore, the bank was able to rapidly revitalize its dated mobile app and deliver a cutting-edge experience boosting customer acquisition, engagement, and satisfaction. The end results were game-changing for this digital transformation initiative.

Java, Kotlin, RxJava, Retrofit, AndroidX, MotionLayout, GSON, Glide, Firebase, Kotlin Coroutines, Jetpack, MVVM, Google APIs

Get a FREE, no-obligation consultation with our experts and unlock personalized strategies that can transform your business with up to 30% OFF on all our offerings.

Contact to schedule your free session and start your journey to success!

Contact Now